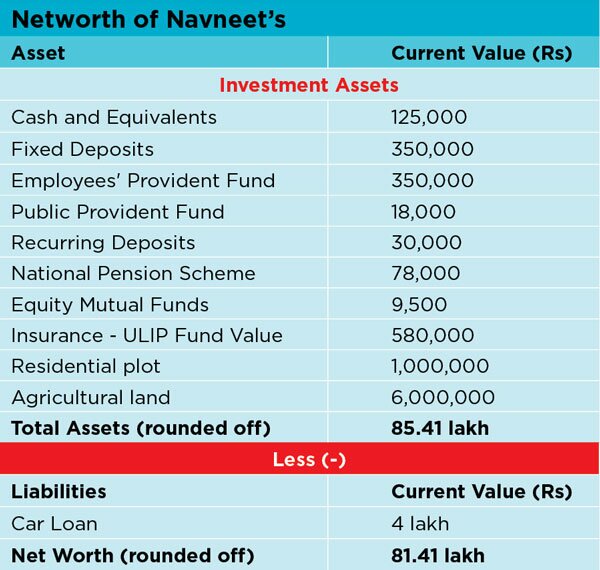

Navneet Kumar is a 35-year-old private employee living in Trivandrum. He lives in a rental house with wife Sweta, 35. His monthly income is Rs 65,250. Of this, a big chunk goes towards household expenses Rs 29,433 (includes house rent Rs 12,756). Additional, Rs 10,091 goes towards EMI for car loan, Rs 6,708 for insurance premiums and Rs 12,000 goes into investments.

“I want advice from a financial expert to purchase my own house in three years and build a corpus for my retirement”– Navneet Kumar

Financial Goals of the Family

The goals for Naveneet’s family include building corpus for down payment of house purchase in three years and creating a retirement fund. Financial advisor Pankaaj Maalde analyses his monthly cash flow, existing investments and future goals. He first analyses his current insurance portfolio and gives recommendation on necessary changes required.

The goals for Naveneet’s family include building corpus for down payment of house purchase in three years and creating a retirement fund. Financial advisor Pankaaj Maalde analyses his monthly cash flow, existing investments and future goals. He first analyses his current insurance portfolio and gives recommendation on necessary changes required.

Analysing Life Insurance Portfolio

Navneet has two Unit Linked Insurance Plans (ULIPs) i.e. Aviva Freedom Life and ICICI Life Time Super Pension. He also holds one online term plan from HDFC with life cover of Rs 50 lakh. Currently, Navneet is adequately covered under life insurance. However, a chunk of his savings goes towards paying the premium of insurance policies. At present, he pays an annual premium of Rs 72,000. Analysing his insurance portfolio, Pankaaj recommends continuing the online term plan from HDFC which has a life cover of Rs 50 lakh and ICICI Pru Pension Plan. He, however, advises to surrender the Aviva ULIP plan immediately due to high on-going charges which reduces the return in long term.

Health and Disability Insurance Planning

As for health insurance, Navneet has bought Reliance Health Gain, insurance policy from Reliance General Insurance with a cover for Rs 6 lakh. The policy bought has permanent exclusions of few common ailments like cataract, gout, hernia, kidney stone which is normally not seen in other health insurance policies. Due to this exclusions, Pankaaj advises to port to other insurer who does not have such restrictive conditions. He advises Navneet to increase the cover from Rs 6 lakh to Rs 10 lakh. This change in health insurance policy will cost around Rs 14,000 p.a. Pankaaj also suggests buying critical illness and accident disability insurance policies with sum assurance of Rs 25 lakh each. This will incur an additional cost of Rs 12,000 p.a. approximately but will ensure a cover for any uncertainty in future.

As for health insurance, Navneet has bought Reliance Health Gain, insurance policy from Reliance General Insurance with a cover for Rs 6 lakh. The policy bought has permanent exclusions of few common ailments like cataract, gout, hernia, kidney stone which is normally not seen in other health insurance policies. Due to this exclusions, Pankaaj advises to port to other insurer who does not have such restrictive conditions. He advises Navneet to increase the cover from Rs 6 lakh to Rs 10 lakh. This change in health insurance policy will cost around Rs 14,000 p.a. Pankaaj also suggests buying critical illness and accident disability insurance policies with sum assurance of Rs 25 lakh each. This will incur an additional cost of Rs 12,000 p.a. approximately but will ensure a cover for any uncertainty in future.

Analysing Loan Portfolio

Navneet has a car loan of Rs 4 lakh with an interest rate of 10.25%. He pays an EMI of Rs 10,091 to the bank. This is one of the major cash outflow from his income. Pankaaj advises that Navneet repays the entire loan from his existing fixed deposit which earns him 7% returns post tax deduction. By repaying personal loan with high interest he will become debt free. This will increase his monthly surplus and the amount saved can be invested in assets with better returns to build the desired corpus for future goals.

Navneet has a car loan of Rs 4 lakh with an interest rate of 10.25%. He pays an EMI of Rs 10,091 to the bank. This is one of the major cash outflow from his income. Pankaaj advises that Navneet repays the entire loan from his existing fixed deposit which earns him 7% returns post tax deduction. By repaying personal loan with high interest he will become debt free. This will increase his monthly surplus and the amount saved can be invested in assets with better returns to build the desired corpus for future goals.

The Road Ahead

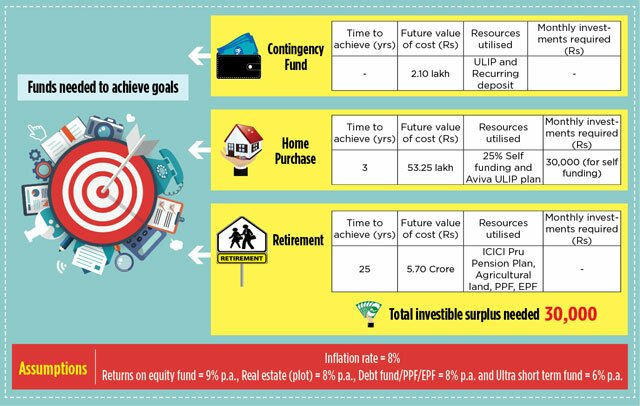

Having taken care of insurance requirements and becoming debt free, Navneet can start planning for his financial goals. The first goal is to set aside six months of expenses as a contingency fund. This amount will take care of any unforeseen expenses for his family. For this, Pankaaj aligns Rs 2 lakh from surrender value of Aviva ULIP plan and Rs 30,000 of recurring deposit (RD). He suggests surrendering the Aviva ULIP plan and stop further investments in RD. This will create surplus funds to invest for house purchase goal. He recommends investing in ultra short term funds with amount from Aviva ULIP plan and RD.

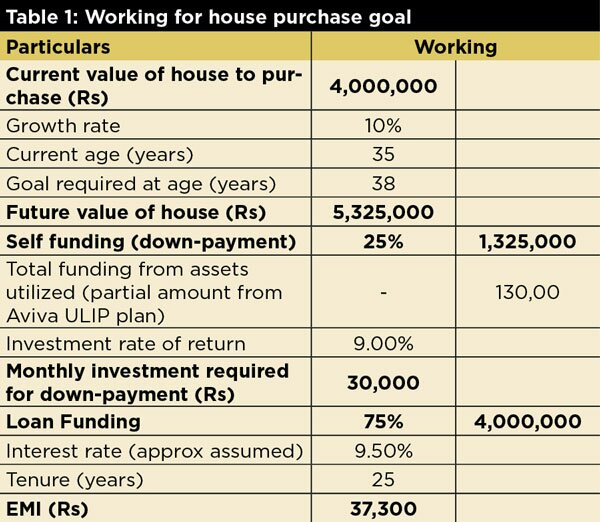

Buying a house is the top priority for Navneet. He plans to buy a house for the total cost of Rs 40 lakh in present value after three years. Out of which 75% will be from bank as home loan and remaining 25% self funding. Pankaaj did the working to achieve house purchase goal for Navneet as explained in the table 1.

Buying a house is the top priority for Navneet. He plans to buy a house for the total cost of Rs 40 lakh in present value after three years. Out of which 75% will be from bank as home loan and remaining 25% self funding. Pankaaj did the working to achieve house purchase goal for Navneet as explained in the table 1.

Pankaaj advises

- Invest the part of Aviva ULIP (Rs 1 lakh) from surrender value in equity income plan of mutual fund for three years time. This investment is expected to grow at 9% and value of investment at a time of house purchase will be Rs 1.30 lakh.

- Build a corpus for self funding (25% down payment). Invest Rs 30,000 per month in equity income fund for two years. Then in third year, consider investing same amount in recurring deposit or arbitrage fund for one year.

- For the balance amount of Rs 40 lakh in house purchase, opt for a home loan. Assuming rate of interest at 9.50% EMI would be Rs 37,300 as explained in table. To pay this monthly EMI, use surplus of Rs 30,000 from current house purchase down payment goal and savings from rental expenses.

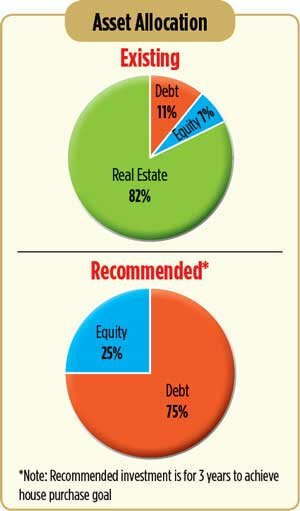

- Align ICICI Prudential Pension Plan, Agricultural land, PPF and EPF which promise a corpus of Rs 41.11 lakh, Rs 4.11 crore, Rs 1.23 lakh and Rs 1.18 crore respectively after 25 years i.e. at the retirement age of 60 years. No additional investment is required to build the desired corpus for retirement which is Rs 5.70 crore and will be used up to 80 years of age after retiring at 60. The corpus required has been calculated assuming household expenses of Rs 35,000 per month in present value at 8% inflation.

- Align ICICI Prudential Pension Plan, Agricultural land, PPF and EPF which promise a corpus of Rs 41.11 lakh, Rs 4.11 crore, Rs 1.23 lakh and Rs 1.18 crore respectively after 25 years i.e. at the retirement age of 60 years. No additional investment is required to build the desired corpus for retirement which is Rs 5.70 crore and will be used up to 80 years of age after retiring at 60. The corpus required has been calculated assuming household expenses of Rs 35,000 per month in present value at 8% inflation.

- Review the real estate investment periodically since major investment is into this asset to build retirement corpus.

- Shift the fund from balanced fund to 100% equity fund in ICICI Pension plan as the goal is long term and to continue investing Rs 1,000 p.a. in PPF account.

Concluding Remark

Navneet should review the plan, rebalance his portfolio periodically and take corrective actions for insurance policies as discussed.

Expert - Certified Financial Planner Pankaaj Maalde prepares a financial plan and gives his recommendation to the family.